Understanding ULIPs: Dual Benefits for Secure Investments

Unit-linked Insurance Plans (ULIPs) offer a unique combination of insurance and investment benefits. When you opt for a ULIP plan, a portion of your premium goes towards life coverage, while the remaining amount is invested in various debt and equity funds based on your preference. ULIPs are considered a good investment option as they have the potential to bring higher returns and help you achieve significant life goals, such as funding your child’s education or planning for retirement. Additionally, ULIP tax benefits can help you manage your tax liability effectively.

It’s important to note that ULIPs come with certain risks since they are market-linked investment products. The performance of the market directly affects the fund’s performance. Therefore, it is crucial for investors to assess their risk appetite before investing in ULIPs. The risk factor may vary depending on the types of funds available for investment under the ULIP.

ULIP Tax Benefits: Saving Taxes While Securing Your Future

When investing in any financial product, including ULIPs, it is important to understand the tax implications. The Government of India provides certain tax benefits for policyholders investing in ULIPs. As per the Indian Income Tax Act, there are two key provisions applicable to ULIP tax benefits: section 80C (deduction for life insurance premium) and section 80CCC (deduction for pension plans). Under these provisions, individuals can claim a deduction of up to Rs. 1,50,000 in a financial year.

Here are some important points to keep in mind regarding ULIP taxation:

- Maximum Deduction Limit: While you can invest more than the maximum deduction limit, which is Rs. 1,50,000, the tax exemption is capped at this amount.

– Example: Let’s say your chosen sum assured is Rs. 15 lakhs, and your annual premium is less than Rs. 1.5 lakhs. In this case, the entire premium amount can be used to avail ULIP tax benefits.

- Premium Limit: The yearly premium should be less than 10% of the sum assured to avail the ULIP tax benefit fully.

– Example: If your annual premium is higher than 10% of the sum assured, the available ULIP tax benefit will still be capped at 10% of the sum assured.

- Minimum Policy Term: To claim ULIP tax benefits, the policy must remain active for at least five years. If you stop paying premiums during the fifth year, any tax benefits availed in the first four years will be withdrawn.

– Example: Suppose you decide to surrender your policy after three years. In this case, any ULIP tax benefits availed within those three years will be reversed. It’s important to stay invested in ULIPs for the long term to maximise tax savings and investment growth.

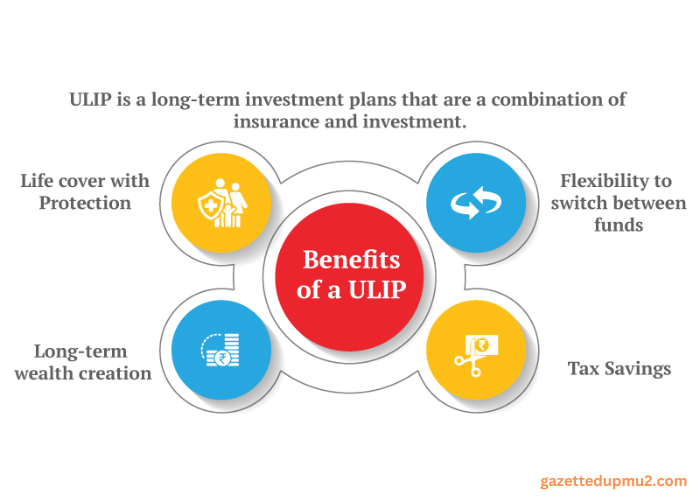

Benefits of ULIP Investments

ULIP investments offer a range of benefits that can help you achieve your financial goals while securing your future:

- Financial Independence: By investing in a ULIP plan for retirement planning, you can ensure financial support during your golden years when you may not have a stable income source. The tax benefits associated with ULIPs also make them a sound investment choice for your present financial situation.

- Life Cover: ULIPs provide life coverage to protect your loved ones in times of crisis. In addition to securing the insured’s life, ULIPs also grow the invested money over time.

- Investment Flexibility: ULIPs offer flexibility in choosing funds for investment purposes. You can switch between funds within the policy term and even make partial withdrawals as per the policy terms and conditions. You can calculate your investment using the ULIP calculator.

- Tax Benefits: One of the key advantages of investing in ULIPs is the tax benefit they provide under section 80C and section 80CCC of the Income Tax Act. The premiums paid towards ULIPs are eligible for deduction up to Rs. 1,50,000 per annum.

Conclusion

ULIPs offer a unique combination of insurance coverage and investment options while providing tax benefits to policyholders. By understanding the various aspects of ULIP tax benefits and maximising their usage effectively, you can secure your future financially while saving on taxes in the present.

As you explore investment options for your financial goals and tax planning strategies, consider utilising the potential of ULIPs to achieve both objectives simultaneously. Remember that ULIPs provide not only financial independence but also life cover and investment flexibility.

Evaluate your risk appetite and choose the funds wisely based on your financial objectives while considering the potential returns and associated market risks.