A forex robot can automatically scan the market and trade based on pre-set parameters. This eliminates the risks associated with human emotions, such as fear and greed, which can negatively affect trading decisions. Human traders are time restrained as they need to take breaks to eat, sleep and other commitments. However, a forex robot can work continuously.

Easy Availability

The ideal forex robot should align with your trading strategy and offer reliability, excellent customer support and a competitive cost. It should also have robust risk management capabilities. It should have no frequent crashes or glitches, as these can lead to missed trading opportunities and losses. It should also be able to maintain a stable connection with the trading server, as disconnections can cause loss of trading data. Look for user reviews and third-party testing results to assess its reliability. It should also be able to backtest, which lets you see how the robot would perform in past market conditions.

If you’re considering purchasing a forex robot, beware of companies that make outrageously profitable claims. These illegitimate robots can easily lose your money. Creating and selling a bot is costly and requires extensive development and testing. It’s also not guaranteed to work for you – it depends on your own personal trading strategies and market conditions.

Removing The Psychology Of Trading

Forex robots are software programs that read market statistics and price charts to predict when a trade should be made. They are programmed with specific parameters that help them evaluate whether a particular trading signal is valid. They can either assist a trader or make trade judgments on their own. A human trader might struggle to overcome their own emotions when deciding to take a trade. These emotions can lead to fear or greed, which can result in bad decisions. The use of a forex robot can help remove these emotional factors from the equation and increase trading efficiency.

Before implementing any robots, traders should look for reliable vendors with positive reviews. They should also do some backtesting to assess their performance and profitability. However, it is important to remember that backtesting results do not necessarily reflect real-time market conditions. Also, one robot’s settings might work well for you but not for another. Therefore, it is important to find a balance between using a forex robot and manual trading.

Scalping

While a forex robot is an excellent choice for traders who cannot afford to trade manually, it is crucial that you choose one with a solid strategy and proper risk management. This will ensure that you are not losing money or overtrading.

Scalping is a technique that allows a trading robot to open or close orders within a short period of time, taking advantage of price movements. This can increase profit margins but may also result in losses if the market moves against your position. Scalping is also risky for some brokers, and it is important to check their policy before using a scalping robot. Be wary of any company that makes grand claims about its forex robots. If a robot was truly groundbreaking, it would be profitable on its own without the need for any human intervention. If you’re suspicious about a company’s claims, look for a backtesting feature to see how it performs under different conditions.

Data-Mining Bias

When choosing a forex robot, it is important to look at its historical trading performance. But it is also crucial to understand the risks that can come with these automated systems. These can include data-mining bias, which occurs when a company cherry-picks its best backtest results to present to potential buyers. This can lead to a false sense of security, and the performance of a bot may not translate to real-world trading.

Manipulative tactics such as these are common within the forex industry, and traders should be aware of them. For example, a forex robot that shows impressive winning streaks may be using scalping strategies, which take small profits from small price changes. This strategy is risky, and a single large loss can wipe out all profits. Traders can avoid these pitfalls by designing their own trading systems, or by looking for reviews and testimonials from third-party sources. They should also consider factors such as slippage and trade execution speed, which can dramatically affect profitability.

Conclusion

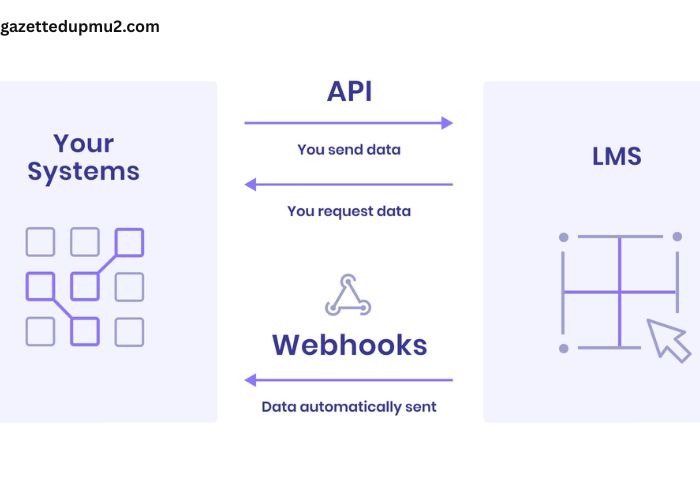

A forex robot is computer software that automatically monitors and trades based on pre-set parameters. It eliminates the need for a trader to continually watch price charts and spend hours making trading decisions. Arbitrage trading robots automatically take advantage of pricing inefficiencies between different brokers. They use a news calendar to generate trading signals around and on economic news releases.